The smart Trick of Paul B Insurance Medicare Health Advantage Melville That Nobody is Discussing

50 per person monthly in 2019., the Medicare Advantage program, is not individually funded; Medicare Benefit prepares provide benefits covered under Part A, Component B, and also (normally)Part D, and these advantages are funded mainly by pay-roll tax obligations, general revenues, and also premiums. Medicare Benefit

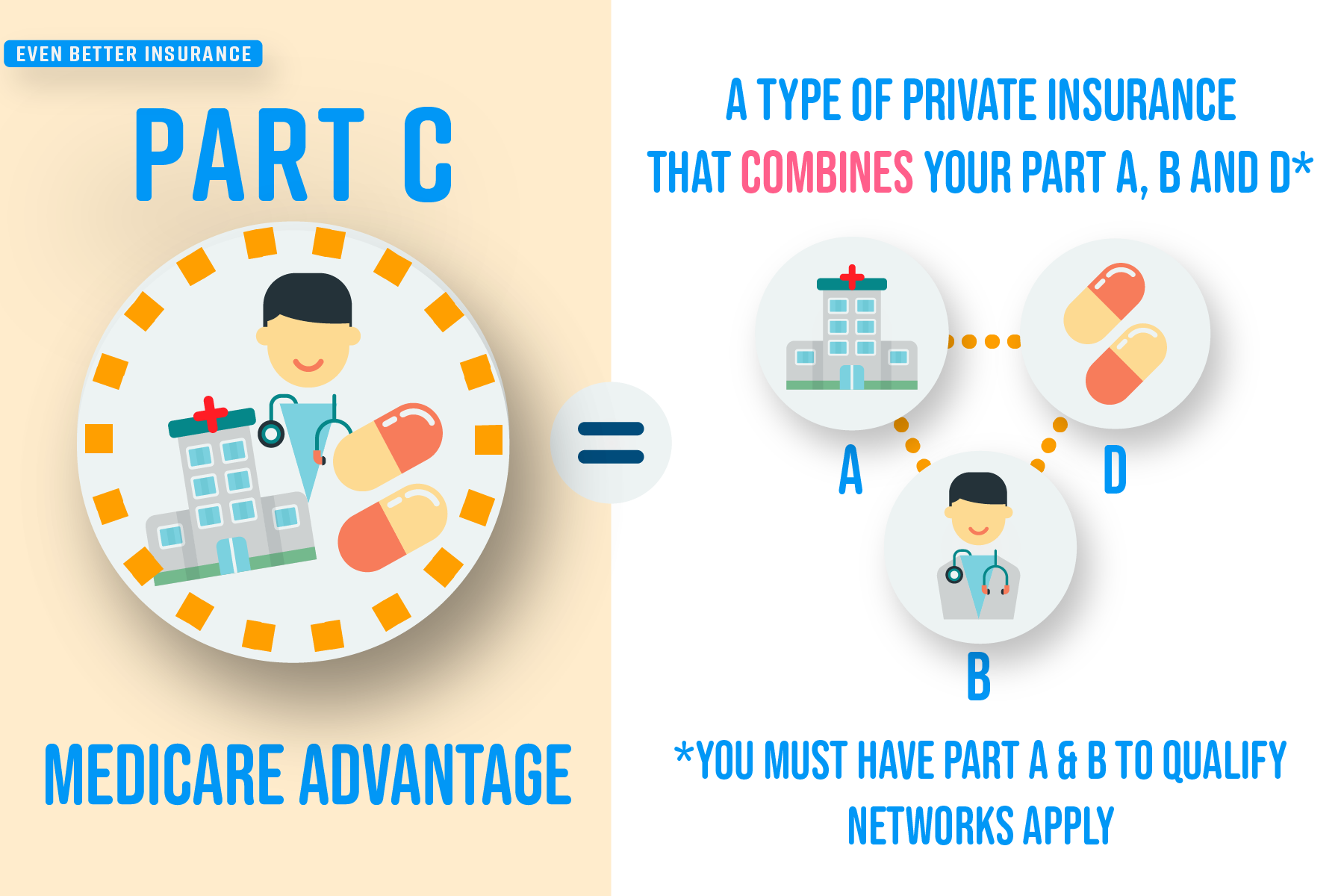

enrollees usually pay the monthly Part B premium and several also pay an added costs directly to their plan. is moneyed by basic revenues, recipient premiums, and state settlements. The average PDP premium for 2018 was$ 41 each month. Part D enrollees with higher revenues pay an income-related premium surcharge, with the same revenue thresholds used for Part B. paul b insurance local medicare agent melville. In 2019, costs additional chargesrange from$ 12. 40 to$77. Policymakers, healthcare carriers, insurance providers, and also researchers remain to question exactly how best to introduce repayment and distribution system reforms right into the healthcare system to deal with rising prices, high quality of treatment, and also inefficient costs. Medicare has actually taken a lead in checking a selection of new designs that include economic rewards for service providers, such as medical professionals as well as hospitals, to interact to lower spending and improve look afterindividuals in traditional Medicare. Accountable Care Organizations(ACOs)are one instance of a delivery system reform model currently being evaluated within Medicare. With over 10 million assigned recipients in 2018, ACO designs allow groups of companies to approve responsibility for the total care of Medicare beneficiaries and also share in financial cost savings or losses depending upon their performance in conference costs as well as care top quality targets. Numerous of these Medicare repayment designs are handled via the Facility for Medicare and also Medicaid Advancement(CMMI), which was produced by the Affordable Treatment Act (ACA). These versions are being evaluated to establish their effect on Medicare investing and the quality of treatment offered to recipients. The Assistant of Health and also Human Being Provider (HHS )is authorized to increase or extend designs that showhigh quality improvement without a rise in costs, or about his costs decrease without a decline in high quality. While Medicare spending is on a slower higher trajectory now than in past years, complete and per head yearly growth rates appear to be bordering far from their traditionally low levels of the previous few years. Medicare prescription medicine costs is additionally an expanding issue, with the Medicare Trustees forecasting a fairly greater per capita growth price for Component D in the coming years than in the program's earlier years because of higher costs associated with costly specialty drugs. As policymakers take into consideration feasible adjustments to Medicare, it will certainly be essential to evaluate the possible impact of these modifications on complete wellness treatment investing and also Medicare costs, as well as on beneficiaries'accessibility to top quality treatment and also inexpensive coverage and their out-of-pocket health and wellness treatment prices. A Medicare Advantage is an additional means to obtain your Medicare Part An and Part B coverage. Medicare Advantage Plans, occasionally called"Component C"or"MA Plans,"are used by Medicare-approved personal firms that should follow rules established by Medicare. If you join a Medicare Benefit Plan, you'll still have Medicare however you'll obtain many of your Part An as well as Component B coverage from your Medicare Benefit Strategy, not Initial Medicare. With a Medicare Benefit Strategy, you might have protection for things Initial Medicare doesn't cover, like physical fitness programs(health club subscriptions or discounts)and also some vision, hearing, and oral solutions(like regular check ups or cleansings).

Fascination About Paul B Insurance Medicare Agency Melville

Strategies can likewise choose to cover much more advantages. Some plans might provide coverage for services like transportation to doctor gos to, over-the-counter medications, as well as solutions that advertise your health and wellness and health. These packages will give benefits personalized to treat certain conditions. Contact the plan prior to you.

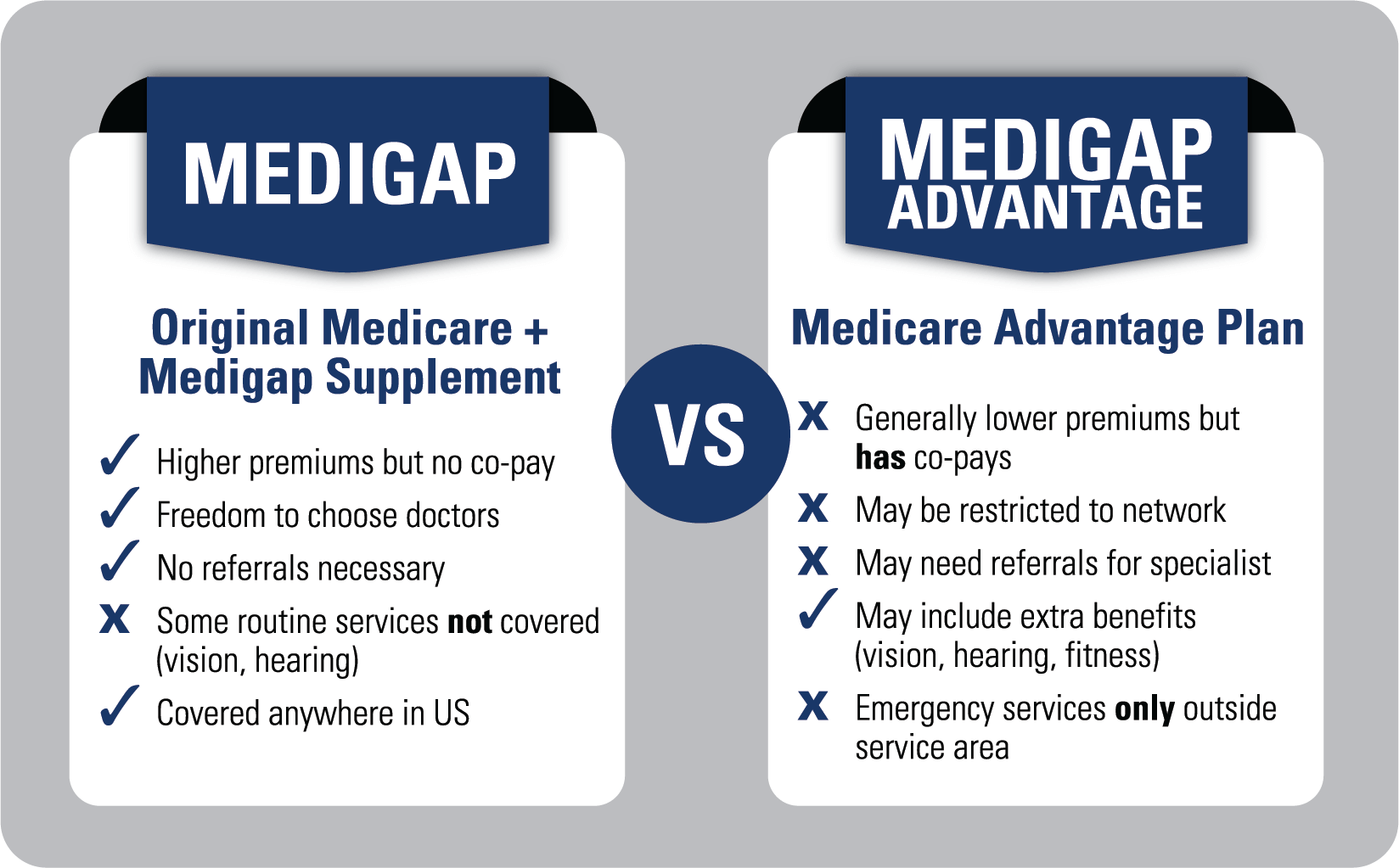

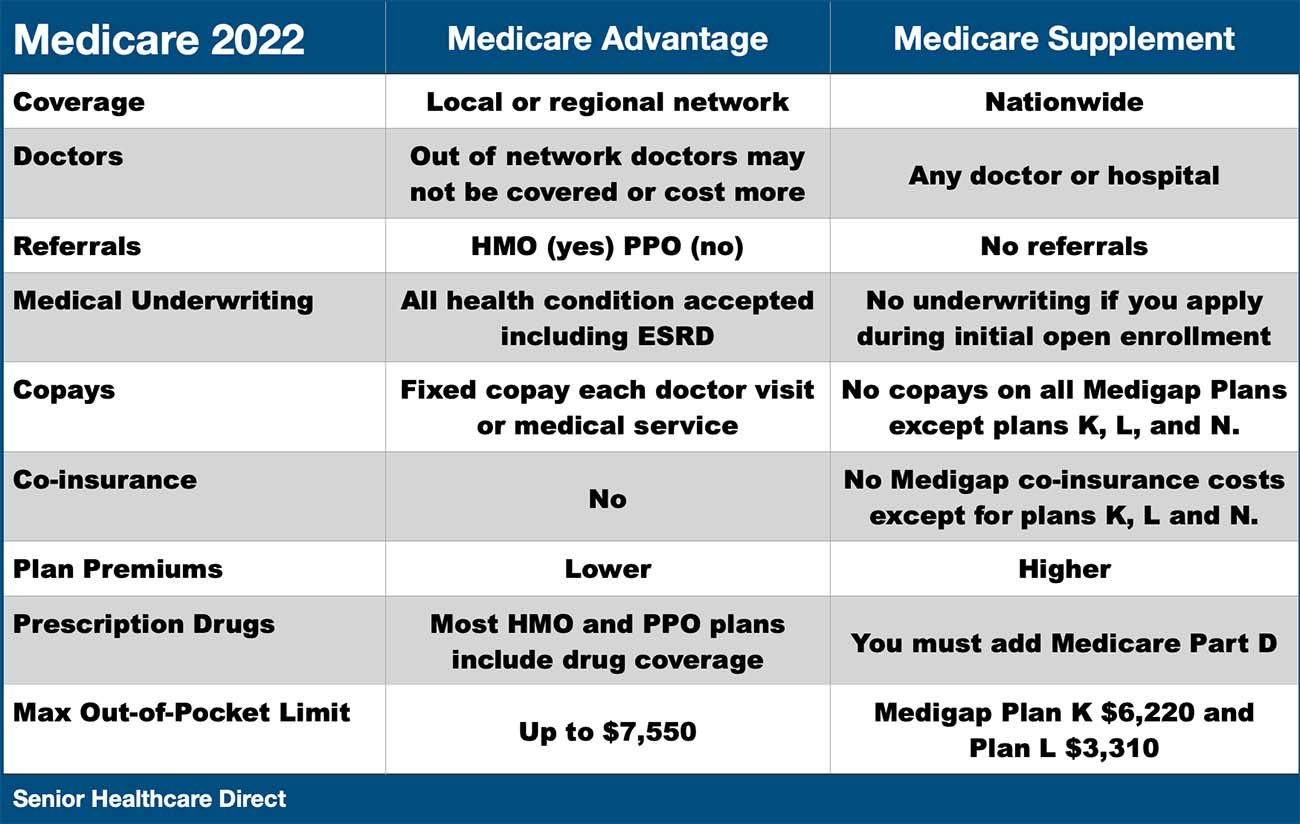

enlist to see what benefits it uses, if you could qualify, and also if there are any constraints. Discover more regarding what bcbs medicare advantage plans Medicare Advantage Plans cover. Medicare pays a set amount for your care monthly to the firms offering Medicare Benefit Plans. Each Medicare Benefit Plan can bill various out-of-pocket costs. They can also have various regulations for how you obtain solutions, like: Whether you require a referral to see a professional If you have to go to doctors, centers, or vendors that come from the prepare for non-emergency or non-urgent care These policies can alter every year. You'll require to make use of health and wellness care carriers that take part in the plan's network. Some plans will not cover solutions from service providers outside the strategy's network as well as service location. Medicare Advantage Strategies have a on your out-of-pocket costs for all Component An and also Part B services. When you reach this limit, you'll

pay nothing for reference solutions Part An and Part B cover. You can sign up with a separate Medicare medicine plan with particular sorts of strategies that: Can't offer medicine insurance coverage (like Medicare Medical Savings Account plans )Select not to supply medication protection(like some Personal Fee-for-Service strategies)You'll be disenrolled from your Medicare Benefit Strategy as well as went back to Original Medicare if both of these use: You remain in a Medicare Benefit HMO or PPO. If you sign up with an HMO or PPO that doesn't cover medicines, you can not sign up with a separate Medicare medication strategy. In this case, either you'll need to make use of other prescription medication coverage you have(like company or retired person insurance coverage ), or do without medication protection. If you choose not to get Medicare medicine coverage when you're first eligible and your various other drug insurance coverage isn't reputable prescription medicine insurance coverage, you might have to pay a late registration charge if you sign up with a strategy later. You can not make use of Medigap to spend for any costs( copayments, deductibles, as well as premiums )you have under a Medicare Benefit Strategy. Find out about your choices connected to Medigap policies and also Medicare Benefit Program. The basic info in this brochure provides a review of the Medicare program. Much more in-depth info on Medicare's advantages, costs, and also wellness solution options is readily available from the Centers for Medicare & Medicaid Solutions (CMS) publication which is mailed to Medicare beneficiary households each autumn and to new Medicare recipients when they end up being eligible for insurance coverage. It offers fundamental protection versus the price of health and wellness treatment, however it does not